Contents

Great to hear the portfolio conversion is going well for former Sears MasterCard holders who have been converted to Scotia’s Momentum Visa card. That said, previous and NEW Scotia cardholders will not have their foreign transaction fees waived. Only those who were converted from the Sears portfolio.

And from a cost perspective, free trades are hard to beat, given that many other discount brokerages charge up to $10 a trade. MetraTrader 5 makes trading so simple and easy to do provided you already have the knowledge to trade the money and capital markets. I enjoy trading on MetraTrader 5 so much as it makes my trading of CFDs so easy unlike other complex trading platforms. Off-shore banking might conjure up images of people hiding their funds from tax collectors of their country of residence. The motion to approve the UBS, BNP and Bank of America settlements, and class counsel’s request for fees, in Ontario is scheduled for November 9, 2016 and in Quebec on November 15, 2016. November 29, 2016 Citigroup Inc., Citibank, N.A., Citibank Canada, and Citigroup Global Markets Canada Inc. (collectively, “Citi”) entered into a formal settlement agreement whereby Citi agreed to pay CAD$21,000,000.

IBKR evaluates the risk in your account, including hedged positions that may mitigate potential downside risk. With rules-based margin, a defined formula determines your margin requirements. It’s the most common type of margin used by day traders. IBKR also offers traders the option of earning interest on shares they lend out. The IBKR Stock Yield Enhancement Program allows traders to earn income on fully-paid shares of stock they hold. Can also refresh their investing knowledge in Qtrade by using the site’s educational tools and articles.

Tool to trade on forex markets

There may be no way to avoid this, however, we’re not sure that getting a credit card like the Rogers card will help with the other half of the equation, which is getting the money from PayPal to your bank. You’re from the US, so converting any US dollars to their Canadian counterparts will cost a foreign transaction fee. If you equip your son with a Canadian credit card for the purpose of paying tuition, when funding the card from your US account, you will still need to pay a transaction fee. We’re sorry to confirm that the Home Trust card isn’t available to residents of Quebec, but a comparable alternative that Quebecers are eligible for is the Rogers Platinum Mastercard.

Its most popular platform, Forex.com, lets you buy and sell currencies quickly and easily for no commission and a low mark-up on foreign exchange spreads. Learn more about how this platform works and sign up for your free account today to start investing. I thought I knew, well in advance, what I was getting myself into with WealthSimple when I decided to set up account with them. My plan was to use the app as an order taker with limit orders and trading leveraged etf’s on CAD markets only (this is to achieve 0% fee trades).

After all you’re using the cash advance function, but the loan itself is being paid down immediately, so no interest. Or you may get charged the fee and the interest , or you may get charged nothing at all. If you use your card for purchases during that time period, in addition to cash advance, you may get dinged the cash advance fee.

Questrade is still, by far, the more robust trading platform. Questrade is the best way to save money on your DIY investing and the way they do that is by cutting fees. Questrade charges no annual fees, and when you start investing, you’ll pay just $4.95 per trade up to a maximum of $9.95 to buy stocks, and $0 per trade to buy ETFs. This means that you can sign up for Questrade, transfer money into your account, and build an ETF portfolio all for $0.

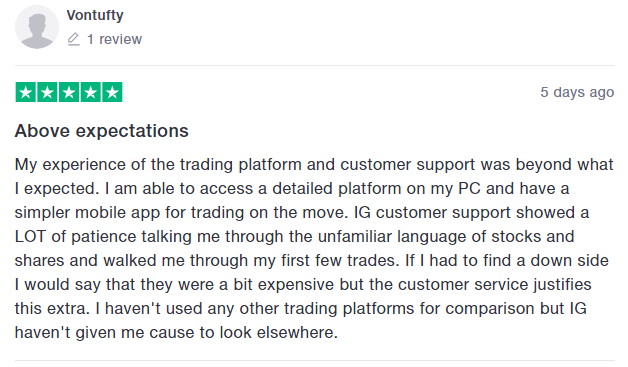

The account opening is free and the trader is guided step by step through the opening process. What more could you want if not the opinions of users, or of ordinary and inexperienced people who, like you, have thrown themselves into this business, perhaps without knowing much. Many of them have discovered a fascinating world of convenient and handy profit opportunities that you can take advantage of today too. The BlackBull Markets broker offers high quality assistance, 5 days a week. While we are independent, we may receive compensation from our partners for featured placement of their products or services.

OANDA among the top best forex trading platform provider

You can also take a quote you’ve received online and bring it to your branch manager. See if they’d be willing to calling into the banks forex department and give you a matching or better rate. We actually bring a quote to our branch manager, who then calls in the foreign exchange desk to see if they’re willing to match it.

- Some brokers manipulate their trading platforms to always be at the disadvantage of traders.

- Wealthsimple will round up the price of your everyday purchases, and deposit this “spare change” into your Wealthsimple Invest account.

- Once your account is created, you’ll be logged-in to this account.

Used to be decent, but now stop hunted regularly at more than 3x the spread when retail positioning is the other direction and CVIX is little to none?? They take the other side of each trade, when you stop out THEY profit –SNEX shareholders like it that way. Unless you know how to put together synthetic bonds, FX is dead, go crypto. We are disappointed you have not had a good experience with FOREX.com. We understand your frustration in this matter and hope you reach out to our support team with more details. Our support team is available by phone, live chat, or email at

A good trading platform that lacks some of the needed currency pairs

Markets are open 24 hours and have a low barrier to entry, meaning even beginner investors can get into forex trading. Trading currency pairs seems highly intuitive – we’ve all at some point closely monitored exchange rates such as CAD-to-USD or USD-to-EUR. If you believe one currency will rise or fall versus its trading pair then you would place a trade making that bet. Hopefully this clarifies why we recommend the Rogers MasterCard for foreign purchases. Rogers is just subsidizing the foreign transaction fee with its high cash back rate on foreign purchases, but is still offering more value than any other credit card alternative in the Canadian marketplace. So in fact, they’re not like any other credit card in Canada – even better than those who simply removed the foreign transaction fee.

The 2.5% foreign exchange fee is not credited, but this fee is not applied to the refund exchange rate. Apply Now If you’re looking for a straightforward credit card that has no foreign transaction fees and no annual https://broker-review.org/ fee, then the Home Trust Preferred Visa will likely appeal to you. The card also earns 1% in cash back on all purchases in CAD, though unfortunately it doesn’t earn cash back for purchases in foreign currencies.

Do not worry because the online brokers we offer have eliminated these costs thus making trading even more convenient and profitable for your pockets, you can in fact trade at the cost of the spread only. A forex broker must make you save for example on trading costs, deposit and withdrawal costs and transaction costs. Some customers complain canadian forex brokers that it’s difficult to get technical advice when there are glitches in the online trading platform. You risk losing money on your trades, especially if your risk appetite is high. You’ll be charged a mark-up on the spread of each trade for standard accounts and a commission for trades (with no mark-up) for high-volume accounts.

Financial Literacy 101: Stocks & Bonds

Compared to other discount brokerages, Questrade wins out as the lowest-cost option for DIY investors. Trade our full suite of markets like FX, indices, shares and commodities our flagship trading platforms designed for serious traders. So we just called TD, CIBC & American Express to see if they could or would waive the foreign transaction fee while we were ostensibly on “vacation” in the United States.

The bottom line is that it is most suited to professional day traders & options traders, so if that’s you, Interactive Brokers makes a lot of sense. The low margin rates and currency exchange options make the brokerage an interesting option for those investors interested in using those semi-exotic tools. Regulators also check that brokers are not making unfounded claims or using dubious marketing tactics. Furthermore, in the case of a conflict, investors have a level of recourse with a third-party body whose express obligation is to protect investors. Beyond regulation, investors should also check reviews from trustworthy sites online where they can read about experiences of other real traders. Many review sites also thoroughly investigate complaints, as well as safety and security issues, such as KYC policies and website encryption standards.

OFX offers options to alert you when a rate you want is reached for example. So for people with a regular need that can wait till rates move this is ideal. Switzerland, Germany, Brazil, and Japan all offer an opportunity to off-set economic risk in the U.S., and by association, Canada. May 20, 2016 UBS AG, UBS Securities LLC and UBS Bank (collectively “UBS”) entered into a formal settlement agreement whereby UBS agreed to pay CAD$4,950,000. The settlement is a compromise of disputed claims and UBS does not admit any wrongdoing or liability. July 27, 2016 BNP Paribas Group, BNP Paribas North America, Inc., BNP Paribas , and BNP Paribas (collectively “BNP”) entered into a formal settlement agreement whereby BNP agreed to pay CAD$4,500,000.

Make sure you have a currency converter handy , so you know the going exchange rate between currencies. Make sure your credit card company knows you’re traveling and have some cash on hand just in case and make sure you have people who can transfer money in case you find yourself in a tight jam. Overall safety will be different between countries so always make sure your personal products are in a secure place. This applies whether you’re in Toronto, Ottawa, Los Angeles, Mexico City, Singapore, Hong Kong, London, Moscow or wherever.

Hello GreedyRates, I need your advice regarding the US-Canada currency exchange. I expect to earn in US funds to be deposited in a US bank account. Those funds will be used to pay Canadian bank loan on a bi-weekly basis. Could you please advise as to what would be the best approach for me to obtain best exchange rate and save on currency conversion fees? If you use your RBC Avion Visa Infinite card for a purchase in the U.S. you will only pay the 2.5% foreign transaction fee, plus Visa’s foreign exchange rate . You could try looking into opening a USD bank account in Canada, which is easily possible, but when trying to use that money you will run into fees as well.

Some other – like Rogers – are bordering with scam, they charge 2.5% conversion fee, then give you 4% “cashback points” that you can spend on Rogers products ONLY, like sports tickets or Rogers phone bills. I have Scotia’s Visa Infinite – a recent foreign-exchange transaction shows a 2.4% difference between the originally-billed amount and the refunded amount the next day. The foreign currency in which the purchase/refund was made did not fluctuate by that much overnight – I checked. Exchange rates are assigned by credit card processors—i.e., Visa, Mastercard or American Express—and not credit card issuers, so one specific credit card can’t be identified as having the best exchange rate. Our studies reveal that Mastercard typically has slightly better rates for major reserve currencies than Visa or Amex—but the difference is so minor that it probably shouldn’t factor into your credit card selection.

Disclaimer – We endeavour to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide. If you are unsure you should get independent advice before you apply for any product or commit to any plan. Set up a Forex.com demo account if you want to get used to the software before you dive into the deep end. It can be difficult for beginners to navigate the risks involved with trading on this type of platform.

Moreover, while HSBC confirmed to GreedyRates that they do no charge a foreign transaction fee with their debit card , they were less transparent on where they derived their conversaion rate from. HSBC specifically said they used the conversion rate provided by the “governing bank” of each country. It would be interesting to compare HSBC’s governing rate to that of the networks , to see if it comes in at the same, lower or higher rate. As a result, a card with no foreign transaction fees, will typically be cheaper than most if not all other currency exchange alternatives available to an individual. However, many places I will be traveling do not accept credit card.

In summary, shopping around for the best foreign exchange rate (including fees!) is in your financial interest if you are moving large amounts back to Canada when you return. If you have holdings of a currency that you think will appreciate against the CAD, perhaps you can leave some or most of these holdings off-shore. Canadian mortgage rates are quite low right now compared to previous decades.